The mortgage and financial services industries are in the midst of a technological revolution. Technology is driving new innovations in the mortgage originations space seemingly every day. Appraisals that used to take upwards of four to five days or longer now take less than half that because platforms that feature consumer-driven digital scheduling tools and an open channel of communication between parties. A three-year study by LendingTree determined that the average time it takes to close on a new purchase transaction in the U.S. has fallen from 74 days in 2017 to 40 days in 2019. That dramatic decline is due, in part, to increased digitization of the mortgage process. Digital technology is disrupting the status quo and ultimately giving lenders the ability to save time and increase revenue opportunities.

CapGemini, a global consulting and technology services firm, says banks need to ‘think big’ to meet evolving customer demands in the digital age. A survey in its annual World Banking Report found that 95% of banking executives agree that the industry is headed in a digital direction, but only 13% have systems in place to provide portions of a digital mortgage experience. That gap shows that there’s a great appetite for innovative technologies but there are also barriers that prevent them from getting a product to market.

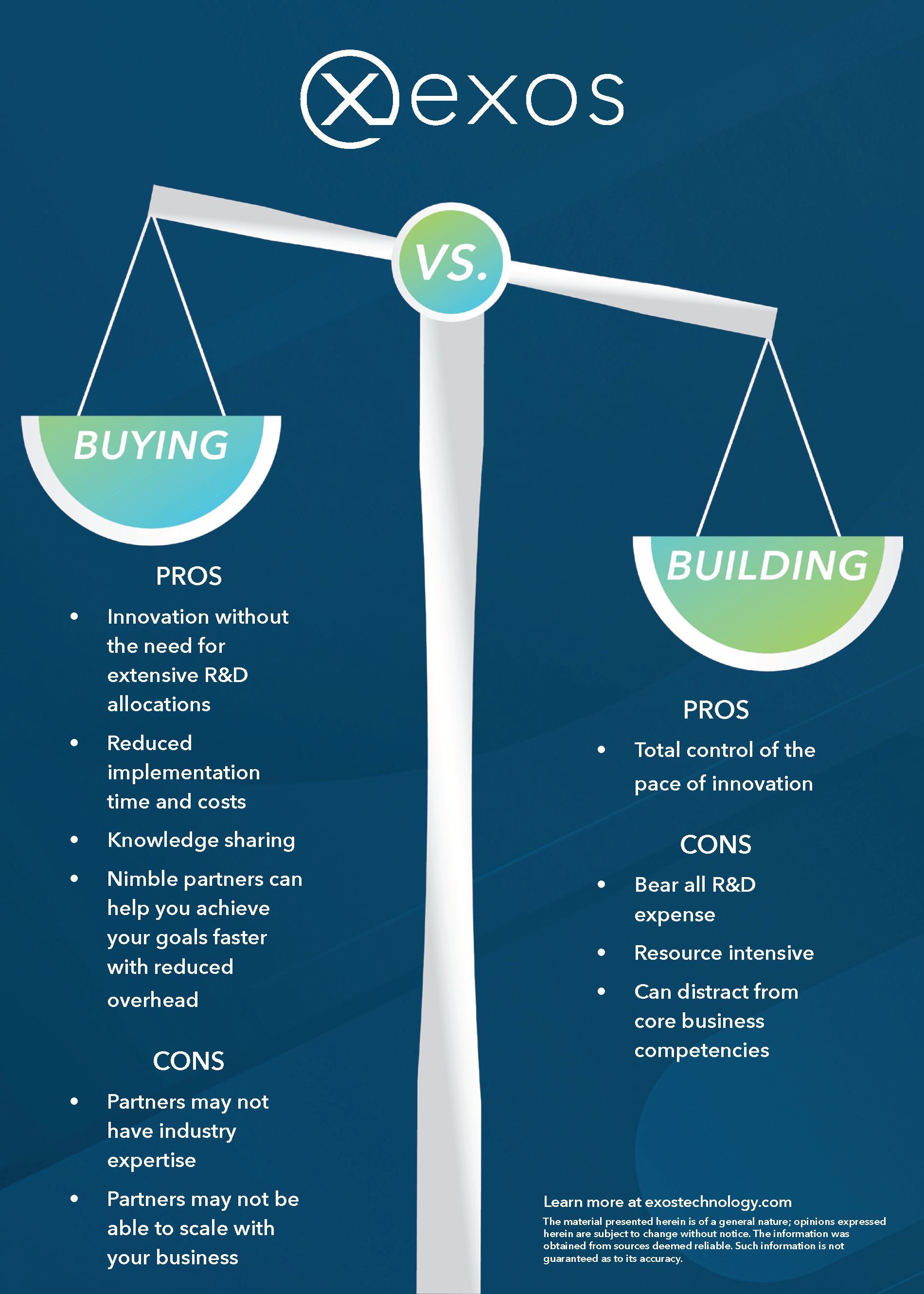

As lenders continue improving their platforms and ultimately their consumer offerings, they face the tough decision of whether to build their own technology stack or buy it. This “build vs buy” debate is never an easy decision and can take a considerable amount of time deciphering which approach is best for a particular institution.

Building Technology

Difficulty and expense: two obstacles many lenders or financial institutions face when considering building their own proprietary technology. Some of the larger banks in the U.S. have impressive tech budgets, but despite the eye-popping figures, many find that the technical knowledge that is necessary to build a platform from the ground up and then support it, is simply out of reach. From concept to development to refinement, building new technology can be a painstaking process and as Forbes put it, ‘financial services firms may find themselves constrained from being able to focus their energies on innovation initiatives.’ While this approach is highly technical and complex, it’s not impossible. In fact, lenders who build their own digital platforms have the opportunity to customize their product for their customers and specific business objectives.

Technology Partnerships

The emergence of fintechs has made it possible for institutions to explore transformative technologies without dedicating extensive time and resources. Fintechs offer the ability to replace or supplement a company’s existing systems (POS, LOS and other platforms) with new, emerging technologies that can solve for inefficiencies in their current mortgage origination process and improve the customer experience. An article in Forbes states, “Fintech firms have the advantage of not being encumbered by legacy systems and processes, and can therefore move faster to develop custom solutions.”

At a fraction of the price to build in-house or proprietary technology, partnerships between financial institutions and fintechs are flourishing. The Financial Brand released its top reasons why fintech solutions and legacy banking organizations create a winning strategy. It found that fintechs enhance performance and profitability, improve customer retention, solve industry-specific pain points and provide insight into what customers are doing with their money. “With a strong fintech partnership, traditional financial organizations benefit from the leverage of a state-of-the-art, secure network that can manage time-consuming and lengthy tasks quickly and effortlessly,” the article said.

The risk in selecting a digital mortgage solution developed by a Silicon Valley-based fintech is that they may not have the industry expertise that the mortgage space requires. In contrast, ServiceLink’s EXOS was developed for and by a mortgage services company. It was founded on proven processes supporting the full life of loan services, and built by the brightest, most forward-thinking engineers in the business to meet a need identified from our decades of consumer-facing mortgage experience. EXOS is time-tested: we used it at ServiceLink first before offering it as a private label commercial technology solution to lenders and servicers to complete their end-to-end consumer digital needs.

Contributors: Sarah Kapis, Melinda Maloney

The material presented herein is of a general nature; opinions expressed herein are subject to change without notice. The information was obtained from sources deemed reliable. Such information is not guaranteed as to its accuracy.