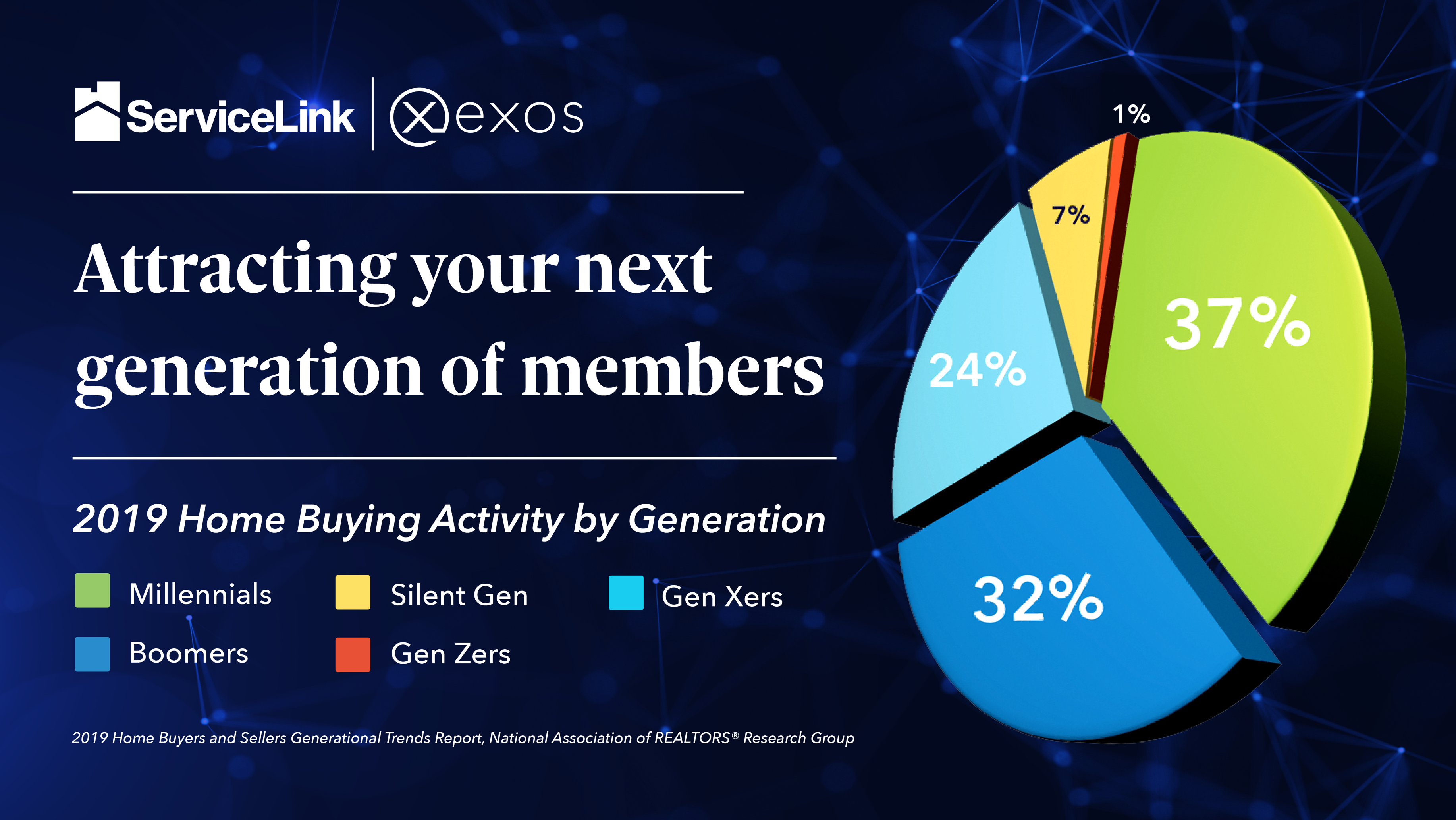

My colleagues Marc Bator, Phil King and I recently hosted a webinar with the National Association of Credit Union Service Organizations (NACUSO). During the session, Denise Wymore, Membership & Advocacy Development Officer with NACUSO, shared a powerful statistic with me: the average age of a credit union member is 47. This fact resonated with me because I know that millennials consistently account for the largest share of homebuying activity – with Gen-Z hot on our heels. Housing experts predict that in 15 years, Gen-Z will surpass millennials in home ownership.

Denise and I (a proud millennial!) agree that millennials and Gen Zers represent a massive opportunity for credit unions to grow their membership base. Reaching these digital native generations is crucial for their continued growth. The key to attracting younger tech-savvy members is offering them a faster, digital mortgage experience.

“Consumers — especially millennials — are taking hands-on control of virtually every aspect of their lives using technology. They schedule ridesharing, make restaurant reservations, even buy cars through a fully digital experience. Why should their mortgage experience be any different?” asks Marc Bator, vice president and principal product manager, EXOS Close. EXOS is ServiceLink’s technology platform.

Meeting my generation’s expectations for a convenient mortgage process begins with the right technology — a platform that ushers them through the mortgage process seamlessly, whether they are buying or refinancing. Phillip King, vice president and principal product manager, EXOS Valuations, also spoke to NACUSO members during the webinar and agrees on the need to extend the digital mortgage experience beyond application.

“When we set out to design the EXOS platform, we saw that a lot of front-facing websites were enabling consumers to complete an application and upload materials online; unfortunately, the digital experience ended there,” says King. “We committed to keeping the experience going — a cool, easy, one-touch kind of experience members appreciate. EXOS is connecting members to credit unions on a whole new level.”

“The EXOS platform extends the digital mortgage experience beyond where most lenders focus today,” says King. “Our platforms helps digitize time-consuming pain points, like scheduling appraisals, which helps credit unions take days or weeks out of the origination process.”

EXOS also offers instant, digital scheduling for closings – which shaves days off of closing timelines – and a variety of virtual closings options compliant in all 50 states. Using EXOS, depending on location, members can conduct their closing fully virtually or with significantly limited in-person interaction. These solutions not only provide members the digital experience they desire but were critical to help credit unions continue closing amid social distance mandates.

ServiceLink enables credit unions to provide a digital mortgage experience that will help them engage new members – without significant technological investment or workflow disruption. And if you don’t engage them, someone else will — a traditional lender that has digitized its processes or one of the many fintech lenders that have entered the market with an end-to-end digital-only experience that appeals to the tech-savvy set. That’s why our team continuously works on advances to equip credit unions with exceptional digitization options.

Bator concludes, “Credit unions have an opportunity to create an outstanding consumer-driven experience that not only attracts the new generation of homebuyer but also encourages them to become members for life.”

ServiceLink is the nation’s premier provider of tech-enabled mortgage services. By partnering with us, credit unions can benefit from our best-in-class technologies, proven experience and a full product suite of services – delivered with an attention to detail and a commitment to helping serve your members. We offer industry-leading valuation, title and closing, and flood services, and our custom solutions teams ensure we provide you and your members personal service. ServiceLink enables our partners in the credit union business and beyond, to achieve their strategic goals, realize greater efficiencies and better serve their members. For more information about ServiceLink, please visit svclnk.com. View our recent webinar with NACUSO.

Melinda Maloney is the marketing lead for EXOS. In this role, she is responsible for EXOS’ overall marketing strategy, including messaging, positioning and tactical execution.